Blog

follow khor and keep up with the latest innovations

- September 15, 2023 in All

Guarding Against the Dark Side of Generative AI: Protecting Your Business from Credit Card Fraud

In an increasingly digital world, businesses rely heavily on credit card processing and payments to facilitate transactions. The convenience of these transactions is undeniable, but it also opens doors for fraudsters to exploit vulnerabilities in the system. As technology advances, so do the tools that fraudsters use.

One such tool is generative AI, which has the potential to increase the sophistication and scale of credit card fraud. In this blog post, we’ll explore how generative AI could be used for fraudulent activities in credit card processing and payments, and the cautions businesses should take to safeguard their operations.

The Rise of Generative AI

Generative AI, powered by neural networks like OpenAI’s GPT or Google’s PaLM or Vertex Large Language Models (LLMs), have the ability to create human-like text, images, and even voices. This technology has been celebrated for its creative potential, such as generating content, automating customer service, and assisting in content creation. However, its power can also be harnessed for malicious purposes.

How Generative AI Could Increase Credit Card Fraud

-

Phishing Scams: Fraudsters can use generative AI to craft convincing phishing emails and websites. These fraudulent sites can mimic legitimate banking institutions, tricking users into divulging their credit card information.

-

Social Engineering Attacks: Generative AI can generate realistic-sounding text messages, phone calls, or chatbots to manipulate individuals into sharing their credit card details or personal information.

-

Deepfake Fraud: Advanced generative AI can be used to create deepfake videos or audio recordings, making it appear as if someone authorized a credit card transaction when they did not.

-

Account Takeovers: By generating fake identification documents, generative AI can facilitate identity theft, allowing fraudsters to take control of existing accounts and make unauthorized credit card transactions.

-

Brute Force Attacks: Generative AI can assist in creating complex algorithms that can crack credit card security codes and gain access to sensitive financial information.

Cautions for Businesses

-

Stay Informed: To combat credit card fraud enabled by generative AI, businesses must stay informed about emerging threats and technologies. Regularly educate employees about the risks and evolving tactics employed by fraudsters.

-

Implement Multi-Factor Authentication (MFA): MFA adds an additional layer of security by requiring users to provide more than one form of identification. This can help mitigate the risk of unauthorized access.

-

Invest in AI-Driven Fraud Detection: Businesses should utilize advanced AI-driven fraud detection systems that can analyze vast amounts of transaction data to spot anomalies and flag potential fraudulent activities.

-

Verify Customer Identities: Implement stringent identity verification processes to ensure that customers are who they claim to be before processing credit card transactions.

-

Monitor for Deepfakes: Invest in technologies capable of detecting deepfake videos or audio recordings that could be used to fraudulently authorize transactions.

-

Employee Training: Train employees to recognize phishing attempts, social engineering attacks, and other fraudulent activities that may exploit generative AI.

-

Regularly Update Security Measures: As generative AI evolves, so should your security measures. Regularly update and upgrade your cybersecurity protocols to stay one step ahead of potential threats.

Generative AI undoubtedly holds immense potential for innovation and growth in various industries, but it also presents new challenges in the realm of credit card processing and payments.

To protect your business and your customers from the dark side of generative AI, it is crucial to remain vigilant, invest in robust security measures, and stay informed about emerging threats. By doing so, you can ensure that your credit card processing operations remain secure and trustworthy in an increasingly digital world.

-

Unlocking Hidden Value: Transforming Merchant Charges into a Strategic Asset March 14, 2023 in Profit

Unlocking Hidden Value: Transforming Merchant Charges into a Strategic Asset March 14, 2023 in ProfitIn today’s rapidly evolving business landscape, finance leaders face a myriad of challenges, from managing cash flow to optimizing profitability. Amidst these challenges, it’s crucial for CFOs and business leaders to constantly seek out untapped opportunities that can enhance their company’s financial performance. One such opportunity lies in reimagining merchant charges as an untapped asset.

Many businesses view merchant charges as necessary expenses, merely a cost of doing business. However, a paradigm shift is underway, wherein forward-thinking organizations are recognizing the potential to transform these charges into a strategic asset. This post aims to shed light on this important concept and guide CFOs, finance professionals, and business leaders in the U.S. on how to leverage merchant charges to their advantage.

Rethinking Merchant Charges:

Traditionally, merchant charges were viewed as unavoidable fees imposed by payment processors. However, advancements in technology, the rise of alternative payment methods, and evolving consumer preferences have created an opportunity for businesses to unlock hidden value within these charges. By reimagining merchant charges as an asset, organizations can turn what was once a cost center into a revenue generator.

Leveraging Data Insights:

Every transaction processed through merchant services generates a wealth of valuable data. CFOs and finance leaders should recognize the immense potential of harnessing this data to gain valuable insights into customer behavior, purchasing patterns, and market trends. By leveraging advanced analytics tools, organizations can uncover actionable intelligence that enables them to make informed business decisions and drive growth.

Strategic Pricing and Revenue Optimization:

Merchant charges can provide a unique perspective on customer profitability. Armed with data-driven insights, finance leaders can segment customers based on their payment preferences and associated costs. This segmentation can inform strategic pricing decisions, enabling businesses to optimize revenue by tailoring pricing structures to individual customer segments. This approach empowers organizations to extract maximum value from their customer base while improving overall profitability.

Negotiating Better Terms:

CFOs and finance leaders should be proactive in negotiating favorable terms with payment processors. Armed with a clear understanding of their transaction volumes, average ticket sizes, and growth projections, businesses can negotiate lower transaction fees or secure volume-based discounts. This strategic approach not only reduces costs but also enhances the overall financial health of the organization.

Exploring New Revenue Streams:

Innovative organizations are exploring opportunities to monetize their merchant charges beyond the transactional level. For instance, strategic partnerships with complementary businesses can enable cross-promotion and revenue sharing, amplifying the impact of each transaction. Additionally, businesses can explore offering value-added services to customers during the checkout process, such as extended warranties, insurance, or loyalty programs. These additional revenue streams can significantly boost the bottom line while delivering enhanced value to customers.

CFOs, finance professionals, and business leaders in the U.S. have a tremendous opportunity to unlock the hidden value within their merchant charges. By adopting a strategic mindset, leveraging data insights, negotiating better terms, exploring new revenue streams, and mitigating risk, organizations can transform merchant charges from a mere cost center into a strategic asset that drives growth, profitability, and long-term success. Embracing this shift has the potential to revolutionize financial strategies and elevate businesses to new heights in today’s competitive marketplace.

Unlocking Hidden Value: Transforming Merchant Charges into a Strategic Asset March 14, 2023 in Profit

Unlocking Hidden Value: Transforming Merchant Charges into a Strategic Asset March 14, 2023 in ProfitIn today’s rapidly evolving business landscape, finance leaders face a myriad of challenges, from managing cash flow to optimizing profitability. Amidst these challenges, it’s crucial for CFOs and business leaders to constantly seek out untapped opportunities that can enhance their company’s financial performance. One such opportunity lies in reimagining merchant charges as an untapped asset.

Many businesses view merchant charges as necessary expenses, merely a cost of doing business. However, a paradigm shift is underway, wherein forward-thinking organizations are recognizing the potential to transform these charges into a strategic asset. This blog post aims to shed light on this exciting concept and guide CFOs, finance professionals, and business leaders in the U.S. on how to leverage merchant charges to their advantage.

Rethinking Merchant Charges:

Traditionally, merchant charges were viewed as unavoidable fees imposed by payment processors. However, advancements in technology, the rise of alternative payment methods, and evolving consumer preferences have created an opportunity for businesses to unlock hidden value within these charges. By reimagining merchant charges as an asset, organizations can turn what was once a cost center into a revenue generator.

Leveraging Data Insights:

Every transaction processed through merchant services generates a wealth of valuable data. CFOs and finance leaders should recognize the immense potential in harnessing this data to gain valuable insights into customer behavior, purchasing patterns, and market trends. By leveraging advanced analytics tools, organizations can uncover actionable intelligence that enables them to make informed business decisions and drive growth.

Strategic Pricing and Revenue Optimization:

Merchant charges can provide a unique perspective on customer profitability. Armed with data-driven insights, finance leaders can segment customers based on their payment preferences and associated costs. This segmentation can inform strategic pricing decisions, enabling businesses to optimize revenue by tailoring pricing structures to individual customer segments. This approach empowers organizations to extract maximum value from their customer base while improving overall profitability.

Negotiating Better Terms:

CFOs and finance leaders should be proactive in negotiating favorable terms with payment processors. Armed with a clear understanding of their transaction volumes, average ticket sizes, and growth projections, businesses can negotiate lower transaction fees or secure volume-based discounts. This strategic approach not only reduces costs but also enhances the overall financial health of the organization.

Exploring New Revenue Streams:

Innovative organizations are exploring opportunities to monetize their merchant charges beyond the transactional level. For instance, strategic partnerships with complementary businesses can enable cross-promotion and revenue sharing, amplifying the impact of each transaction. Additionally, businesses can explore offering value-added services to customers during the checkout process, such as extended warranties, insurance, or loyalty programs. These additional revenue streams can significantly boost the bottom line while delivering enhanced value to customers.

CFOs, finance professionals, and business leaders in the U.S. have a tremendous opportunity to unlock the hidden value within their merchant charges. By adopting a strategic mindset, leveraging data insights, negotiating better terms, exploring new revenue streams, and mitigating risk, organizations can transform merchant charges from a mere cost center into a strategic asset that drives growth, profitability, and long-term success. Embracing this shift has the potential to revolutionize financial strategies and elevate businesses to new heights in today’s competitive marketplace.

INNOVATIVE IDEA: Drive Significant Cost-savings Directly to Your Bottom Line March 14, 2023 in All

INNOVATIVE IDEA: Drive Significant Cost-savings Directly to Your Bottom Line March 14, 2023 in All2023 promises challenges for every company. Tightening costs and margins, turbulent labor supply, and unsteady financial markets make planning and execution difficult.

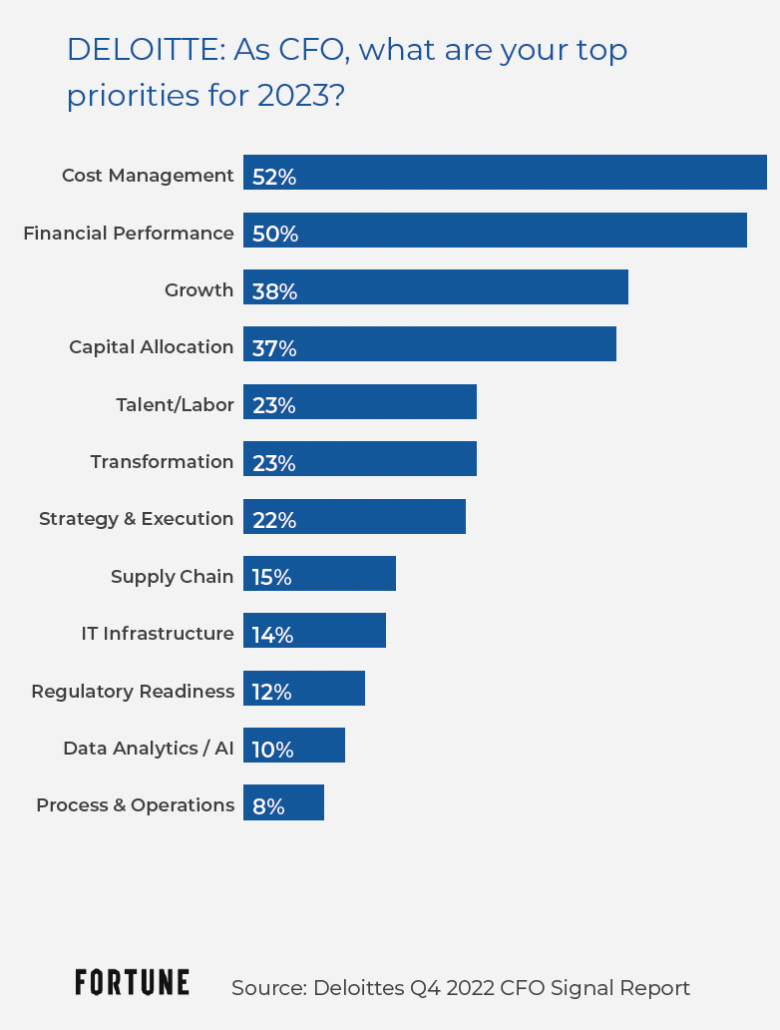

A recent study from Deloitte revealed that finance leaders’ biggest challenges are cost management, financial performance, and growth.

Financial leaders need to be more innovative than ever in order to offset the current economic headwinds and continue to drive profits for their organizations. This can be achieved by identifying new business opportunities, developing new products and services, and finding ways to improve existing ones. Innovation can also involve implementing new technology and automation, which can help to streamline operations and reduce costs.

In addition, financial leaders should also be looking to diversify their revenue streams and explore new markets, in order to mitigate risks and increase their potential for growth. Ultimately, innovation is essential for staying competitive in today’s fast-paced business environment and for achieving long-term success.

Neutralize discount fees and drive significant cost-savings directly to the bottom line.

This new, innovative approach is for companies with significant merchant processing volumes. Companies that process =>$250M annually may qualify. These companies are known as “elite merchants.”

For financial leaders of elite merchants, there is an opportunity to achieve a return on discount fees and even share in merchant processing profit streams by using a new, disruptive approach. Major companies in retail, eCommerce, and B2B have started utilizing this approach, but Khor Capital is now offering the opportunity to elite merchants through its unique Vertical Payment Architecture (VPA) solution.

What Companies Qualify?

• YES if you process over $250 USD million annually

• YES if you have subscription-based or high volume charges

• YES if you and in the following sectors: technology, retail, ecommerce, media, entertainment, travel

• YES if you are US-based

After nearly two decades in the processing space, Khor is challenging industry conventions by partnering directly with elite merchants, enabling fees that had historically been paid to outside parties to be redirected back into a newly created partnership.

Illustrative example: For a company paying $5M in annual discount fees, Khor’s offering could return as much as $5M-10M in fees to the elite merchant. By leveraging Khor’s industry expertise, significant cost centers can be neutralized. Khor fronts all costs and ensures full functionality prior to any switch.

4 EXPERT TIPS: Improve Profits and Reduce Expenses February 15, 2023 in All

4 EXPERT TIPS: Improve Profits and Reduce Expenses February 15, 2023 in AllData from Grant Thornton reveals finance leaders’ top priorities related to improving their firms’ financial position in 2023.

Considering CFO prioritizations in this survey data, finance leaders can directly impact the bottom line by being innovative and disciplined in these four fundamental best practice areas:

1) Vendor negotiations: Negotiating better deals with suppliers and vendors can significantly reduce costs and improve the bottom line. According to a report by the National Procurement Institute, “a 1% reduction in supply chain costs can increase profitability by as much as 12%.”

2) Data-driven decision-making: Using data and analytics to make informed decisions can help finance teams identify areas where they can reduce costs and increase efficiency. A report by Accenture found that groups “that effectively use big data can achieve as much as 41% more profitability than those that do not.”

3) Automation: Automating manual processes and tasks can help reduce errors and save time, freeing up resources for other tasks. A report by McKinsey found that “automation across an organization can increase productivity by 30% and reduce costs by 20%.”

4) Employee training and development: Investing in employee training and development can help improve their skills and job performance, leading to increased efficiency and cost savings. A report by the Society for Human Resource Management found that “investing in employee development can increase profitability by as much as 14%.”

Sources:

National Procurement Institute, “The Power of Strategic Sourcing” (report, 2002)

Association for Financial Professionals, “Cash Management Best Practices” (report, 2013)

Accenture, “The Power of Big Data Analytics” (report, 2016)

McKinsey, “The Impact of Automation on the Workforce” (report, 2018)

Society for Human Resource Management, “Investing in Employee Development: A Strategic Priority” (report, 2020)

FINANCE LEADERS: Leverage Technology to Bolster Your Bottom Line February 15, 2023 in All

FINANCE LEADERS: Leverage Technology to Bolster Your Bottom Line February 15, 2023 in AllAre you a leader of change and innovation, or a number cruncher?

While many finance leaders have made great strides in innovating and improving their departments, they may still struggle to realize the real potential that a true digital transformation can offer. By harnessing digital technologies to enhance data-processing capabilities, the finance team could become its organization’s strategic center for analytics and advice.

According to Forbes, “Companies leading with digital transformation are seeing nearly twice the revenue growth of those not so digitally inclined. But it depends on what part of the company is involved.” A survey by Valoir states, “Those at the high end of profit-margin growth often take advantage of technology to launch completely new business models with dramatically different cost structures than they had previously operated.” For financial departments, success is tied to the ability to significantly automate manual internal processes to reduce costs, move to cloud technologies, and implement new service models, even self-service for certain areas, like payroll.

Captia states, “Only 18% of financial management systems are hosted in the cloud. Without cloud infrastructure, many organizations will continue to struggle to adopt a more efficient and agile operating model for the finance function.” Digital transformation for finance teams is important, but it’s also important for the entire company as it will help drive revenue across departments. Valoir reports, “Companies scoring 8 or higher on a 1-10 scale showed roughly twice the revenue growth compared to companies scoring 3 or less. Digital transformation drives both revenue and margin improvements by improving efficiency.”

Economic Impact of Rising Rate Environment on Large Merchants February 9, 2023 in All

Economic Impact of Rising Rate Environment on Large Merchants February 9, 2023 in AllAs many know, LIBOR was replaced by SOFR (Secured Overnight Financing Rate) in January of 2022. Since that time, interest rates have steadily increased. More specifically, SOFR has increased 410 basis points from 0.05% to 4.15% from January of ’22 through January of ’23.

The impact of this increase will be considerable, if not catastrophic to many large corporates—especially those that operate on narrow margins. To provide a little more perspective, many large companies have corporate credit facilities, which carry floating rate pricing. It would not be uncommon for a $2B company to have at least a $250M RLOC (Revolving Line of Credit), with >50% of that facility funded on a regular basis.

in early 2022, the annual interest on that credit facility (assuming a SOFR + 200bp rate) would have been $3,075M. Today, without considering any other changes to the terms, the annual interest expense would be $9,225M; an increase of $6,150M. This represents a 200% increase in the company’s interest expense during a time of significantly compressed margins.

Without boring you all with more narrative, that same $2B company is likely paying ~$2M / year in merchant processing Discount Fees. Their net annualized net revenue (if partnering with Khor) could be ~$4M, resulting in a positive Delta of ~$6M / year. This completely erases the $6M increase in interest expense referenced above. If ever there were a better “natural hedge” of uncontrollable variable costs, I’m not aware of one.

John Krusoe, CEO, Khor Capital

Recent Posts

Guarding Against the Dark Side of Generative AI: Protecting Your Business from Credit Card Fraud In an increasingly digital world, businesses rely heavily on credit card processing and payments to facilitate transactions. The convenience of these transactions...

Unlocking Hidden Value: Transforming Merchant Charges into a Strategic Asset

In today's rapidly evolving business landscape, finance leaders face a myriad of challenges, from managing cash flow to optimizing profitability. Amidst these challenges, it's crucial for CFOs and business leaders to constantly seek out untapped opportunities that can...

INNOVATIVE IDEA: Drive Significant Cost-savings Directly to Your Bottom Line

2023 promises challenges for every company. Tightening costs and margins, turbulent labor supply, and unsteady financial markets make planning and execution difficult. A recent study from Deloitte revealed that finance...

Unlocking Hidden Value: Transforming Merchant Charges into a Strategic Asset

In today's rapidly evolving business landscape, finance leaders face a myriad of challenges, from managing cash flow to optimizing profitability. Amidst these challenges, it's crucial for CFOs and business leaders to constantly seek out untapped opportunities that can...