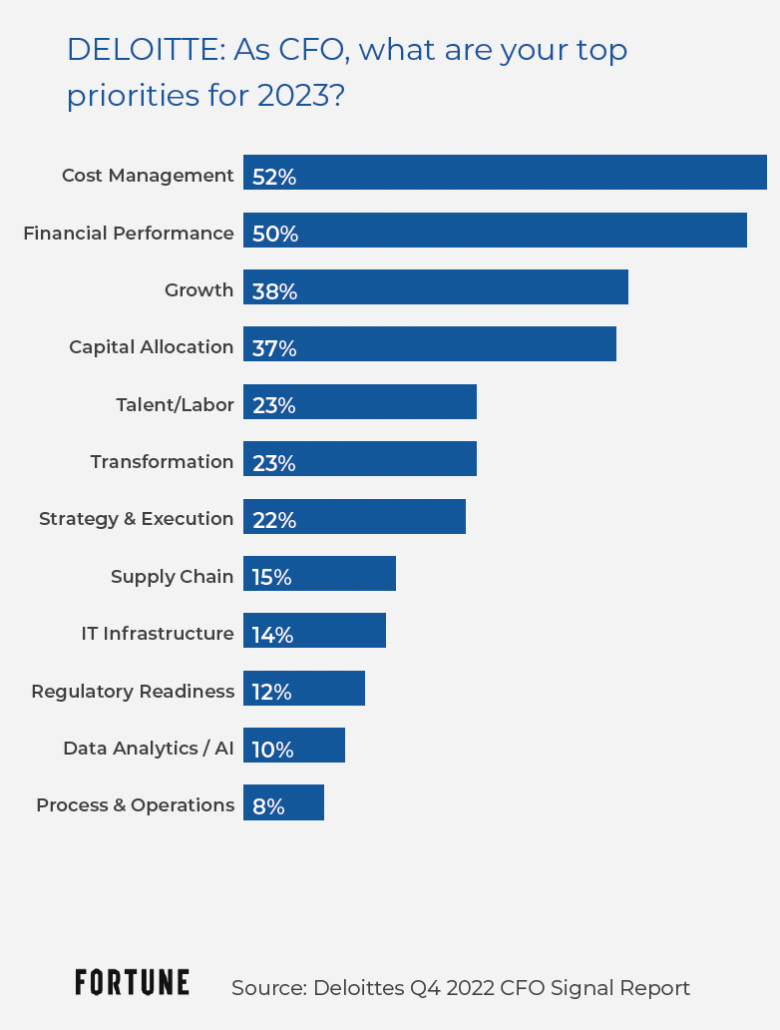

2023 promises challenges for every company. Tightening costs and margins, turbulent labor supply, and unsteady financial markets make planning and execution difficult.

A recent study from Deloitte revealed that finance leaders’ biggest challenges are cost management, financial performance, and growth.

Financial leaders need to be more innovative than ever in order to offset the current economic headwinds and continue to drive profits for their organizations. This can be achieved by identifying new business opportunities, developing new products and services, and finding ways to improve existing ones. Innovation can also involve implementing new technology and automation, which can help to streamline operations and reduce costs.

In addition, financial leaders should also be looking to diversify their revenue streams and explore new markets, in order to mitigate risks and increase their potential for growth. Ultimately, innovation is essential for staying competitive in today’s fast-paced business environment and for achieving long-term success.

Neutralize discount fees and drive significant cost-savings directly to the bottom line.

This new, innovative approach is for companies with significant merchant processing volumes. Companies that process =>$250M annually may qualify. These companies are known as “elite merchants.”

For financial leaders of elite merchants, there is an opportunity to achieve a return on discount fees and even share in merchant processing profit streams by using a new, disruptive approach. Major companies in retail, eCommerce, and B2B have started utilizing this approach, but Khor Capital is now offering the opportunity to elite merchants through its unique Vertical Payment Architecture (VPA) solution.

What Companies Qualify?

• YES if you process over $250 USD million annually

• YES if you have subscription-based or high volume charges

• YES if you and in the following sectors: technology, retail, ecommerce, media, entertainment, travel

• YES if you are US-based

After nearly two decades in the processing space, Khor is challenging industry conventions by partnering directly with elite merchants, enabling fees that had historically been paid to outside parties to be redirected back into a newly created partnership.

Illustrative example: For a company paying $5M in annual discount fees, Khor’s offering could return as much as $5M-10M in fees to the elite merchant. By leveraging Khor’s industry expertise, significant cost centers can be neutralized. Khor fronts all costs and ensures full functionality prior to any switch.